China market overview

Chongqing Port on the Yangze River, Western China

Markets within markets

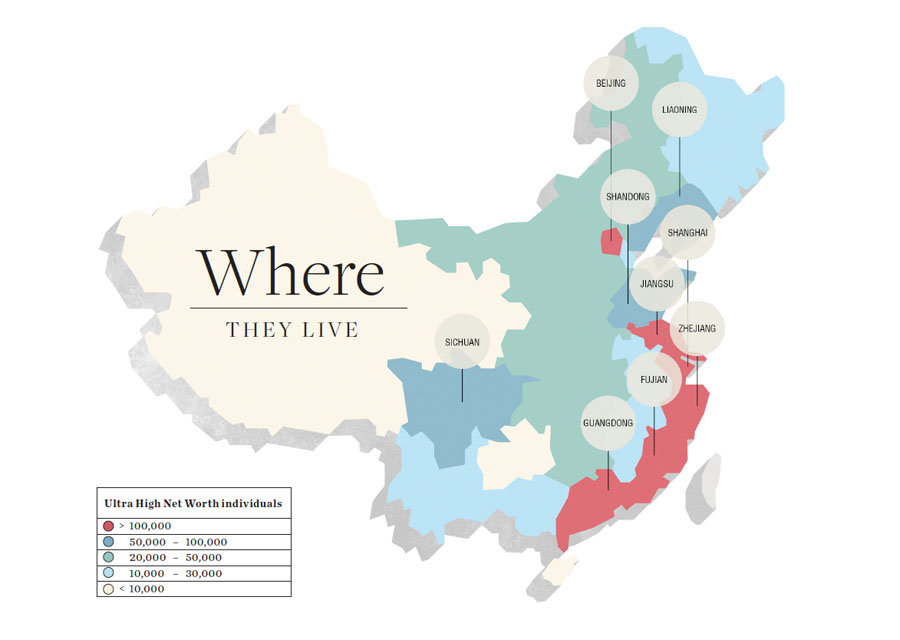

Producers contemplating export to China are advised to research the country and gain an overview of its geography and economy. There is no single ‘Chinese market’, and the sheer scale and complexity of China make it essential to focus on regions and cities which have the wealth and infrastructure to support profitable marketing of premium food.

The People’s Republic of China (PRC) has a population of more than 1.38 billion and is the world’s second largest country by land area, covering 9.6 million square kilometres. The PRC is governed by the Communist Party, which exercises jurisdiction over 22 provinces, five autonomous regions[1], four direct-controlled municipalities[2] (Beijing, Tianjin, Shanghai and Chongqing) and two mostly self-governing special administrative regions[3](Hong Kong and Macau). It also claims sovereignty over Taiwan.

China has hundreds of major cities, which are classified by a tier system based on stage of development, including factors such as GDP, infrastructure and investment.

There are generally considered to be only four first-tier cities: Beijing, Shanghai, Shenzhen and Guangzhou, which together account for less than 10 per cent of China’s overall population. More than 50 cities, each with at least several million residents, fall into the next two tiers.

Shanghai: a booming metropolis with a population of 24 Million

Shutterstock

In recent years, the centre of China’s economic growth has shifted from the east coast to the second- and third-tier cities in provinces further inland. China’s inland cities have been growing faster than their east-coast counterparts, which have received the majority of Australian investment and engagement historically.

With around 20 million people moving from the Chinese countryside into cities each year, the number of second- and third-tier cities is growing, with intense competition among them for national prominence

To sustain and grow sales in China, Austrade is encouraging Australian companies to view China’s second- and third-tier cities as export opportunities. Already, Australia has a strong record of trade with these cities. Trade with Shandong province, for example, was worth AU$3.49 billion in 2012 (Austrade, 2013). Third tier and many second tier cities must be treated with caution with regard to export of fresh food, however.

Cold chain logistics key to market selection

When selecting ports of entry and destination markets, beef exporters must pay particular regard to the quality of cold-chain logistics, customs, compliance and last-mile distribution services in those markets. China’s vast and varied geography presents complex distribution challenges. Port, road, rail, air and shipping infrastructure is evolving rapidly and ranges from the best to the worst in the world. Moreover, the culture and regulatory arrangements surrounding food safety and fraudulent activities such as substitution and counterfeiting may vary across regions.

NSW Farmers research focussed on two second-tier cities, Hangzhou and Chongqing, both of which have strong demand for additional supplies of premium beef, and relatively strong compliance and cold-chain logistics infrastructure. A good rule of thumb when selecting target markets is to consider the cities where Chinese ecommerce majors such as Alibaba, JD.com and Yiguo operate their own cold chain distribution systems. The market presence of these firms corresponds closely to the distribution of wealth in the population. These firms have made billion dollar investments in logistics on the basis of their understanding of demographics and demand trends.

Australian beef marketed on T.Mall by a Chinese importer

Alibaba

Change drivers in the Chinese economy

China’s economy has undergone significant transformation and rapid growth in the three decades since the PRC Government implemented free-market reforms. In recent years, the Government has recognised the need for structural reforms to assist the nation’s economy, from a focus on export manufacturing to a more sustainable view of domestic consumption and services, and less emphasis on debt-financed public investment.

As a result, China has entered a period of economic easing and corresponding slowdown in imports and financial market volatility. According to the International Monetary Fund (IMF), growth in China is expected to slow to 6.3 per cent in 2016 and 6.0 per cent in 2017, compared to global growth projections of 3.4 and 3.6 per cent respectively (IMF, 2016).

With regard to trade, a general slowing of the economy is unlikely to reduce demand for imported food. In the next five years, China’s population is forecast to increase to 1.4 billion and to grow in wealth to comprise 66 per cent of the world’s middle class.

China needs to feed 22 per cent of the world’s population with only 7 per cent of its farmland and 6 per cent of its water resources.

Demand factors for imported food

There are 63,500 ultra-high net worth individuals in China with assets of more than 100 million Chinese yuan (US$15.8 million).

The Chinese Luxury Consumer White Paper 2012

Health and food safety are dominant concerns for Chinese consumers and Australia has a strong reputation in this regard. Middle class and wealthy Chinese will pay a premium for food they trust but research purchases of expensive goods carefully and are highly selective. Consumer packing beef in Australia and providing a strong provenance story is the best way to achieve premium prices in Chinese markets. For more about demand for beef in China and consumer preferences see Demand Trends for Beef in China.

Bibliography

Austrade. (2013, October). Insight - China’s second and third tier markets for Australian goods and services. Retrieved April 18, 2016, from Austrade.gov.au: https://www.austrade.gov.au/Australian/Export/Export-markets/Countries/C...

IMF, I. M. (2016). World Economic Outlook - Update January 2016. IMF.

[1] Autonomous regions are specific areas associated with one or more ethnic minorities who are nominally given a number of rights not accorded to other administrative divisions.

[2] Directly Controlled Municipality is the highest-level classification for cities used by the People's Republic of China. These cities have the same rank as provinces and form part of the first tier of administrative divisions of China.

[3] Self-governing autonomous territories are defined as those that fall within the sovereignty of the People's Republic of China, yet do not form part of mainland China: they include Hong Kong and Macau.